New ULIP norms of IRDA will come to effect from 1.9.2010. Analysts say that this will affect Private Life Insurance Companies and not LIC! Excerpts from a story in marketwatch.com:

"We believe these new pricing norms would have adverse effects on medium-term growth outlook, as well as new-business margins of private-sector insurance companies," brokerage India Infoline wrote in a note to clients recently.

It said new-business premium income for private insurers would unlikely show any growth in fiscal 2011, given the high dependence on ULIPs (some private players get up to 90% of their business from ULIPs).

"We forecast negative to zero growth in new-business premium income for [fiscal 2011]. We expect growth outlook to remain modest in [fiscal 2012] as well."

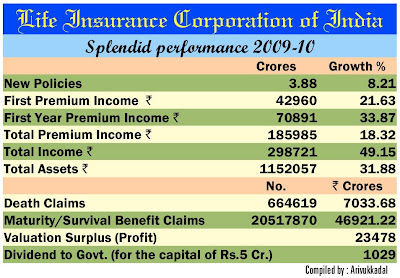

However, the changes are expected to deal a much softer blow to state-owned Life Insurance Corp. of India. With $238 billion in assets, LIC is the country's largest insurance company, holding 70% of the life-insurance market by premiums and number of policies. Its huge base, along with a valuation surplus -- a company measure of profitability -- of about $4 billion, make it better prepared to weather this storm.

Also, LIC's army of about 1.4 million insurance agents gives it an unmatched reach. At the same time, its dependence on ULIPs is much lower than for private players, as it continues to offer a host of plain- vanilla insurance products.

Source: Marketwatch