Private insurers are not even snapping at LIC’s heels

It has been more than a decade now that private insurance players have been trying to gain a foothold in the market. But despite tying up with global leaders and having some of the best brains on board, private insurers seem to be headed nowhere.

Private sector insurers are witnessing rapid erosion in market share. Despite having been around for a decade, even reaching break-even seems a distant dream for a number of them. On top of this, private players are even planning initial public offerings (IPOs)!

The numbers do all the talking. Between March 2009 to September 2010, domestic giant Life Insurance Corp of India (LIC) increased its market share in terms of first year premium to 73.27% (from 60.77%) while its market share in terms of number of policies increased to 72.20% (from 70.52%).

Moneylife calculated the first premium market share of life insurance companies as of September 2009 and September 2010, based on data from the Insurance Regulatory and Development Authority (IRDA). We considered first-year premium of individual single, individual non-single, group single and group non-single policies.

The writing on the wall couldn't be any clearer. LIC has taken away market share from almost all the players.

So is this endgame for private operators? How long will they keep flogging tired revenue models and continue to support balance sheets bleeding red?

Coming back to the IPOs that these private insurers are planning, IRDA is currently readying its guidelines for such offers. Already, questions are being asked over the quality of disclosures mandated and whether investors would really be able to analyse the prospects of such companies.

Speaking about the challenges in the valuation process of insurance companies at a seminar held in Mumbai recently, Ashvin Parekh, partner and national leader - Global Financial Services, Ernst & Young Pvt Ltd, said: "Disclosures for profitability of different product lines should have been made long ago. It would have helped not just for IPOs, but also for corporate governance. But the regulators have already missed the boat by 7-8 years. The authorities kept dragging their feet on Embedded Value (EV) disclosure even after three committees have gone into it. They kept saying it was too technical for them. If it is introduced now, it is impossible for investors to get (an) accurate picture from the disclosure that will be submitted to regulators as per the new guidelines. The regulators should have taken the lead, but confirmed the age-old belief that business is always ahead of regulators."

But regulatory lapses aside, why have private insurers not been able to take on the public sector behemoth? Agreed, LIC is huge, its size bigger than the GDP of almost 80% of countries in this planet- but whatever happened to private ingenuity and nimbleness?

Till 2000, LIC enjoyed a monopoly. But elephants can dance, too. After the market was thrown open to private players, it got its act together. According to TS Vijayan, chairman, LIC, "The company felt threatened, but made changes and prospered."

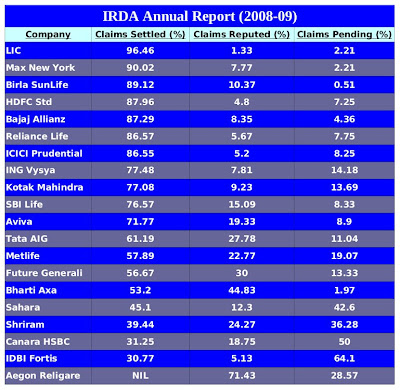

According to Vipin Anand, chief-corporate communications, LIC, "The opening (up) of (the) insurance sector to private insurers did shake us up, but LIC responded well due to its intrinsic strength. We have 14 lakh agents as of today who cover every part of the country. We were the first government company to go for computerisation. Our computer network is (the) largest in the country after the Indian Railways. Even with the volume of our business we are able to have speed ratio (settlement within stipulated time, usually 30 days) of settling claims at 97.47% (maturity claims) and 95.29% (death claims) for 2009-10. We have excellent investment expertise to manage funds in-house."

Is it too late for private insurers to go back to the drawing board?

Courtesy: Moenylife