Private Life Insurance Cos. hiked Mortality charge in new ULIPs

despite increase in life expectancy

Longevity should reduce mortality charges. Instead, many insurance companies have resorted to increasing it. It could be just another way to deceive customers and fill their coffers through the additional charges.

The average life expectancy in India for males has increased from less than 60 years in the 1990s to over 67 years today, mainly due to medical advance. One would have expected that this would result in lower mortality charges in life insurance calculations. However, the reverse seems to be the reality.

Mortality charges of new ULIPs have gone up. Indian insurance companies use LIC's mortality table (which was prepared 15 years ago) as a base and combine that with their own claims experience and expenses to price products. This is a subjective matter and hence the mortality charges of insurers vary, but there is no downward trend.

The cover story in a recent edition of Moneylife magazine exposed how insurance companies have not really reduced premium allocation and the policy administration charge. The new ULIPs carry more charges than old ULIPs over a period of five years or more.

Interestingly, many insurers have also increased the mortality charges, probably because it is outside the cost cap of the Insurance Regulatory and Development Authority (IRDA). Insurers are becoming creative in finding ways to levy charges on customers. In some cases, the payment for accidental death benefit is more in new ULIPs and hence the mortality charge has been increased substantially.

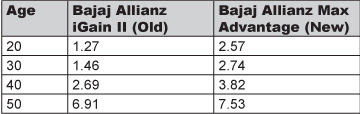

The Bajaj Allianz Max Advantage brochure specifies that in case of death the company will pay the sum assured and the fund value to the nominee. Apart from this, an additional sum assured shall be payable if the cause of death is an accident, subject to the policy being in force. These additional benefits that were not provided by Bajaj Allianz iGain II (Old) has jacked up the mortality charge substantially. (The tables indicate the mortality charge per Rs1,000 sum assured for a male life in the old and new ULIPs.)

The Reliance Classic plan brochure specifies that an additional amount equivalent to the base sum assured is payable in the case of accidental deaths. The additional benefit has jacked up the mortality charge substantially.

Birla Sun Life Dream Endowment plan (new) does not give an additional benefit, but it has increased the mortality charge for the younger age groups and reduced it for older age groups following on a study of mortality experience.

Moneylife tried to contact Bajaj Allianz, Birla Sun Life and Reliance Life on the justification for the increased charges, but did not get any response from these companies.

Aviva and Metlife have also hiked mortality charges by about 10% and 20% respectively.

Courtesy: Moneylife

Great. Give us a chance to safeguard your life and your money. To find out more, click the link LIC Consultant Near Me in Faridabad to go to the website of our business.

ReplyDelete